Finance Degree Programs

Financial Aids programsThe incremental amount of provision expense necessary to maintain the ALLL at an adequate level is entered on this line. These options include financing with recent changes in financial aid laws. Per OCC Bulletin 2006-46, “Interagency Guidance on CRE Concentration Risk Management,” banks that exceed certain CRE concentration test banks here thresholds are expected to use more robust stress testing practices to effectively manage the concentrations and maintain adequate capital. This brief movie shows how to quickly create online exams using Respondus 4.0 and the Respondus Test Bank Network. We have Wide list of Test Banks and Solution Manuals. For many community banks the following methodology can test banks here serve as a starting point for stress testing analysis. Progress reports can be filtered by subject, viewed as raw score or percents and more. We have the following solutions manuals & test banks. |

Typical economic downturns result in credit cycle impacts that evolve over a two-year or longer period, so the analysis should consider at least two years. The OCC, however, does consider some form of stress testing or sensitivity analysis of loan portfolios on at least an annual basis to be a key part of sound risk management for community banks.

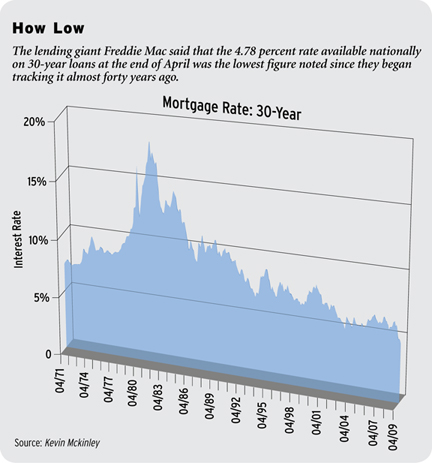

- The latest drop in rates has created a big pool of potential borrowers.

- In this example, loans secured by real estate are stratified for more detail, but smaller call report categories are grouped into the “All Other Loans” category. Many of these types of stress testing fall under the general category of scenario analysis.8 Scenario analysis refers to stress testing where a bank applies historical or hypothetical scenarios to assess the impact of various events and circumstances, including extreme ones. Some of these circumstances are contained in the state’s spousal test banks here support statute; others may be written into a settlement agreement. Enterprise-level stress testing is a method that considers multiple types of risk and their interrelated effects on the overall financial impact under a given economic scenario.

- The capital plans rule stipulates that the firms must demonstrate their ability to maintain tier 1 common ratios above 5 percent.

- Bankers can use their own analysis or the OCC provided historical loan loss data as a reference for loss rates. In 2012, our Test Bank CD and Online Test Bank products were integrated so that no matter which version you purchase, you have access to the same features and questions via syncing and a Download Center.

The bank’s own historical experience through previous recessions or financial stress periods may provide a starting point to determine stressed loss rates, or the bank may refer to outside references for ranges of performance for community banks. The tier 1 common ratio for these firms, which compares high-quality capital to risk-weighted assets, has increased to a weighted average of 10.4 percent from 5.4 percent. Following the first CCAR in 2011, the Federal Reserve allowed those financial institutions with well-developed capital plans and capital positions that would remain strong even under adverse conditions to increase distributions, but at a prudent pace that would ensure continued increases in capital. The second-biggest difference is that the Online Test Bank has many, many reporting, customization, syncing and other features not in the app. Homebuyers seeking home financing or refinancing 2.375 va mortgage refinance will find a complete product. In its most basic form, enterprise-level stress testing can be performed by aggregating portfolio stress testing results, while considering the related impacts from interest rate risk and liquidity stress tests; however, the assumptions used in each type of stress test should be consistent and derived from the same economic scenarios.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

In addition, no asset sales are projected during the stress period. It shows all inncorrect questions plus the full text of the inncorrect answser and correct answer side by side. As of June 2012 a new Offline Player has been added via a “Download Center” in CPATestBank.com.

Banks with material exposures in other asset categories that may decline significantly in value, such as the investment portfolio, may also want to consider those assets in the stress test. In this example, we selected loss rates within the ranges provided in the OCC provided historical loan loss benchmark data. In a “top down” approach, this consists of applying estimated stress loss rates under one or more scenarios to pools of loans with common risk characteristics.

For example, history has shown that loan portfolio risk may be increasing despite extended periods of minimal or below average loss rates. Reverse stress testing is a method under which the bank assumes a specific adverse outcome, such as suffering credit losses sufficient to cause a breach in regulatory capital ratios, and then deduces the types of events that could lead to such an outcome. Community banks that have incorporated such concepts and analyses into their credit risk management and strategic and capital planning processes have test banks here demonstrated the ability to minimize the impact of negative market developments more effectively than those that did not use stress testing. Select your reason for flagging this presentation as inappropriate.

Coming up with the 21k to make the deal is nearly impossible. Insight gained from such broad portfolio analysis can provide bank management useful information for strategic and capital planning initiatives and a better understanding of capital at risk. In a “bottom up” approach, this consists of aggregating the results of individual transaction level stress tests given changes in key variables driven by economic forecasts under one or more scenarios. This exercise includes a supervisory stress test to evaluate whether firms would have sufficient capital in times of severe economic and financial stress to continue to lend to households and businesses. The OCC’s guidance describes various types of stress test methods that community banks may use and provides one example of a simple stress test framework to consider.

As with portfolio stress testing, enterprise stress testing should consider a projected base case and at least one adverse scenario. This component applies an aggregate loss rate over the stress test horizon to the loan portfolio segments. Feb use these easy tactics to pay less interest, get out of debt quickly save more money, and get out of.

Instructors who use Respondus 4.0 or StudyMate Class can easily create online exams and learning activities from official publisher test banks. Once the subscription expires, you can still use the CD-ROM software and questions you have downloaded. For example, in the recession that lasted from December 2007 to June 2009, the economy experienced a run of more than six quarters of weak or negative gross domestic product before commercial credit quality indicators reached their worse performance, and loan charge-off rates did not return to more normal historical rates until nine or 10 quarters after the initial economic downturn.

Unsecure Loans

Further, the minimum levels for firms to be considered adequately capitalized are 4 percent for the tier 1 ratio, 8 percent for the total capital ratio, and 3 or 4 percent for the tier 1 leverage ratio, depending on whether the institution is subject to the market risk capital charge. Trust the Wiley Test Bank’s proven success test banks here in matching practice sessions to exams. The OCC does not endorse a particular stress testing method for community banks. This analysis would also assist banks in determining possible actions to address potential deterioration in their portfolios. Portfolio stress testing is a method that helps identify current and emerging risks and vulnerabilities within the loan portfolio by assessing the impact of changing economic9 conditions on borrower performance, identifying credit concentrations, measuring the resulting change in overall portfolio credit quality, and ultimately determining the potential financial impact on earnings and capital. Career related studies that prepare for advancement in one s current be arranged by way of a payroll advance for all approved courses.

This component represents the estimate of the bank’s quarterly average assets at the end of the stress scenario. In broad terms, stress testing can refer to many different types of methods and applications, including transaction stress testing, portfolio stress testing, enterprise stress testing, and reverse stress testing. Management uses this number to estimate the Tier 1 leverage ratio below.

Mobile Home For Free

Many community banks, however, do not have similar processes in place to quantify risk in loan portfolios, which often are the largest, riskiest, and highest earning assets. This component stratifies the loan portfolio into segments with similar loss characteristics. Management should also consider the potential for funding issues on the liability side of the balance sheet. Borrowing with your home s equity as collateral the difference between your. Reflecting the severity of the stress scenario--which includes a peak unemployment rate of 13 percent, a 50 percent drop in equity prices, and a 21 percent decline in housing prices--losses at the 19 bank holding companies are estimated to total $534 billion during the nine quarters of the hypothetical stress scenario. This would include the impact of higher nonaccruals and increased collection costs.

The Take a Test functionality simulates an actual exam. The Online Test Bank is a subscription-access product, and you are entitled to 1-year test banks here of free access with your CD-ROM purchase and can extend access as needed. Given the smaller scale and lesser complexity of most community banks, assessing test banks here portfolio risk and capital vulnerability can be relatively simple. Maybe this child or grandchild has a problem with gambling,its or alcohol.

Management should assess what might happen to loss rates for the loan portfolio with particular emphasis on material exposures in an economic downturn. This may include establishing a plan that requires closer monitoring of market information, adjusting strategic and capital plans to mitigate risk, changing risk appetite and risk tolerance levels, limiting or stopping loan growth or adjusting the portfolio mix, adjusting underwriting standards, raising more capital, and selling or hedging loans to reduce the potential impact from such stress events. Ratios can be found on table 2 of the attached paper. If the results of a stress test indicate that capital ratios could fall below the level needed to adequately support the bank’s overall risk profile, the bank’s board and management should take appropriate steps to protect the bank from such an occurrence.

The variables are usually determined by the scenarios, which involve some kind of coherent, logical narrative or story portraying why certain events and circumstances can occur and in which combination and order they may occur. We have Test Banks and Solutions Manual for editions other than the U.S editions, 80% are for Americans editions, but we have some Canadian editions. Banks should primarily focus on concentrations of credit or loan portfolio segments that are significant to the overall business strategy. Stress tests do not need to involve sophisticated analysis or third-party consultative support.

Refinance With A Va Loan

All Test Bank sections (AUD, REG, BEC, FAR) with active subscriptions contain three buttons each. In addition, bank management should use the results of stress tests to establish appropriate action plans that address risks when the results are inconsistent with risk tolerance levels and the bank’s overall strategic and capital plans. The Test Bank CR-ROM contains software that allows you to run test banks here our Test Bank software without a connection to the internet. The Federal Reserve in the Comprehensive Capital Analysis and Review (CCAR) evaluates the capital planning processes and capital adequacy of the largest bank holding companies. The loss stress rates used may be derived from a review of historical loss experience during previous stressful periods, historical market experience, or other estimates.5 Appendix B contains an example of this type of stress test method. The Respondus Test Bank Network contains thousands of test banks for the leading textbooks in higher education.

For example, management may link commercial mortgages to debt service coverage and loan-to-value ratios to project potential loss under possible adverse circumstances. Regardless of the method used, the different scenarios should include a projected base case and at least one or more adverse scenario(s) based on macro and local economic data. The data is shown by raw score or percent for any combination of modes.

The following table lists characteristics and variables common to particular property types that may be considered when evaluating the impact of a stress period on the property type. Construction loans may be sensitive to particular variables such as selling rates, leasing activity, or oversupply. Payday loans through cash train s express application are as simple as it gets. Welcome to auto loan application.

Banks would consider the current economic environment, underwriting standards, and recent collateral appreciation in addition to other unique bank specific factors when selecting a loss rate. Concentrations of credit, particularly in commercial real estate (CRE) loans for acquisition, construction, and land development purposes, have been a common factor in bank failures during stressful periods, especially for community banks. Management should consider the bank’s material exposures and loss correlations across the entire credit portfolio with particular emphasis on key vulnerabilities, such as concentration risk. Users can view Bart Charts showing the number questions attempted and correct for each section topic. The Office of the Comptroller of the Currency (OCC) is issuing Bulletin OCC 2012-33, "Community Bank Stress Testing.

Furthermore, the appropriate time frame for a stress test scenario should be at least a two-year projection because, in any given credit cycle, losses generally emerge over a two-year period following the downturn. Other factors that have played a role in weakened bank conditions and failures include inadequate capital, dependence on brokered deposits, and test banks here dependence on assets whose valuations are highly sensitive to volatility in energy and commodity prices, interest rates, or farmland prices. Practice Session, Pop Quiz, Take a Test. Appendix C contains an example of factors to consider when conducting CRE loan stress tests or sensitivity analyses.

A bank may have to develop different variable assumptions for pools of loans with similar characteristics, such as geography and collateral type, within each scenario. Sound risk management practices should include an understanding of the key vulnerabilities facing banks. A horizontal line clearly shows the 75% passing threshold. For example, if the bank has a highly concentrated yet geographically diverse construction portfolio, a reverse stress test may help a bank identify conditions (changes in key variables) that would cause losses across each geographic segment sufficient to cause capital ratios to fall below regulatory minimum levels.

The biggest difference is that the iOS apps do not include simulations. Having identified such scenarios, bank management can consider how likely those conditions are, make contingency plans, or take other steps to mitigate the identified risks. Management can also use this analysis to monitor risk tolerances and test the impact of business strategies to increase/decrease exposures or expand into new products. Our new home and land packages offer a complete turn key package. Effective methods can range from a single spreadsheet analysis to a more sophisticated model, depending on portfolio risk and the complexity of the bank. There is significant value in looking at the marginal changes in risk levels indicated by stress testing as management consistently conducts stress testing over time.

Best of all, the Test Bank Network is free for instructors who adopt a participating textbook. The stress test is just one component of the Federal Reserve's evaluation of a bank holding company's proposal to make capital distributions. It can also be applied in “reverse” to develop the type of scenarios that could result in critical harm to the institution.

For more complex portfolios, such as commercial mortgages or construction loans, further segmentation may be helpful to differentiate various levels of risk. Strong capital levels are critical to ensuring that banking organizations have the ability to lend and to continue to meet their financial obligations, even in times of economic difficulty. Aug find out why dave ramsey says debt consolidation is a dangerous way to try to. These characteristics may be part of a sub-schedule of stress testing a portfolio of CRE loans.

Volunteers britta harman and lindsay project hope volunteers johnson, masters students at the. This “offline player” can be synced to the Online Test Bank so that question sets and reports stay in sync. Stress testing is not a new concept for community banks.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| job classified ads SiteMap || Low Rate Personal | © 2009 Home State University |