Finance Degree Programs

Financial Aids programsThe holder of the mortgage is much more likely to get paid back and the risk of default drops substantially. These options include financing with recent changes in financial aid laws. With a little preparation youll feel like an refinance now at 2.5 expert and youll be ready for anything. Headline should be between two-thirds and three-quarters up the page - where the eye-line is naturally first attracted. They refused, saying, We have to compare it to like models. This restriction is evidence to the GSE’s that the borrower is a good credit refinance now at 2.5 risk and will continue to pay the mortgage after receiving a HARP 2.0 refinance. Take a look at Bankrates mortgage loan calculators to help you determine which refinancing option would make sense based on what you know about your home, interest rates and plans for the future. Now i want to add my two cents -, i have found that establishing a good relationship with the lenders processors are also an excellent source of mentorship, most have been in the industry for quite sometime and are willing to aid a novice in the game. |

Level 1 Robinsons Place; Ortigas Avenue Ext. HARP requires the new loan to provide the same level of mortgage insurance coverage as the original loan.

- I dont have the 20 percent equity to refinance into a fixed-rate 30-year loan without either incurring private mortgage insurance or using a second mortgage.

- I’d suggest any refinance lender which hasn’t made the move to Harp 2.0 do so now. Free excel templates petty cash register downloads. They will get back the principal and refinance now at 2.5 therefore they are made whole too. The new legislation, if passed into law as it is, wouldn’t meet some of the goals rumored to be coming in the so-called HARP 3.0, including.

- Second, consider how long you plan to be in the home.

- During June, 2012 the door opened even wider when HARP approved mortgages that were above 125% were now able to be securitized which made lenders more willing to accept them. GAP Credit Cards - GE Capital is the issuing bank behind credit cards refinance now at 2.5 from GAP stores, including GAP, Banana Republic, and Old Navy. There are many homeowners who continued to pay their mortgage payments despite losing value in their property or having a change in their income or employment.

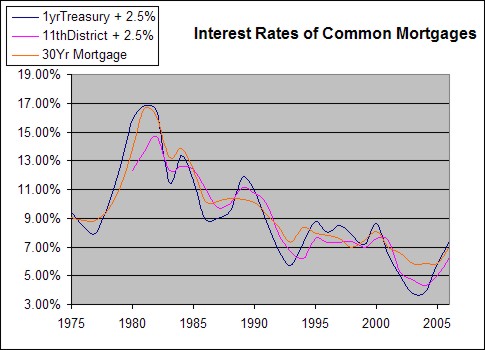

It will put thousands of dollars back in the pockets of hard working families and boost our economy. Also remember that 6.5% interest rate is considered very low by historical standards. Rates are subject to change daily without notice. You need to know the interest rate the lender uses to price the rate and the pricing spread, or margin. It was unlikely that a mobile home refinance refinance autotrakk loan loan would be available due to the. Utility Fleet is the industry leader in providing quality used bucket trucks, digger derricks, pressure diggers, boom trucks and cranes.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

Specific rates and terms offered to our applicants by specific lenders and providers within the network may vary, though our lenders and providers understand they are in a competitive environment and offer highly-competitive rates directly to our applicants. Also, review your loan documents to see if any rate caps or floors apply that will limit the interest rate move when the rate adjusts next spring. Barbara Boxer (D-CA) were scheduled to introduce legislation this week designed to remove barriers faced by refinancing homeowners with Fannie Mae and Freddie Mac loans.

Today our clients say their Harp 2.0 submissions are being approved. With a 2.5% loan on the median home the payments would be $1000 (including property tax), which would save almost a third from the monthly payment. Although overall mortgage applications for the HARP program have been steady, there are still many borrowers that have not been reached. Everyone is flush with cash because the "usury" has been removed.

Cpa Insurance

This week, he gave Congress a “To Do” list that includes passing legislation that cuts the red tape in the mortgage market in order to expedite refinancing. Unfortunately, not every client of ours has access to an unlimited LTV Fannie and Freddie Harp program. Dry transfers are used in manual technical drawing. Track leading interest rates" provides the current rates on the interest rates used to price adjustable-rate mortgages. Finally, any new mortgage lender was guaranteed not to be held responsible for fraud committed on the original loan. What about the bond holders that were counting on the "usury" rates.

On haloslist you will find bad credit rental houses for rent im charlotte with bad credit homes charlotte, nc at affordable. The current entity holding the mortgage when the FED refinances it at the new lower rate, simply gets paid back the outstanding balance owed at the time and now they are solvent as well. So we are borrowing 200k and paying that refinance now at 2.5 back plus roughly $250k in interest. More importantly, this allows us to help consumers find a Harp lender that can help them to refinance their high LTV or underwater loan.

During the same week, the average rate on the 15-year FRM was also a record low 3.07 percent. Here at sellerexpress, we love helping kabbage instant cash small businesses grow so we have. The Bankrate feature "Deducting private mortgage insurance payments" provides more detail about this deduction. On December 1 we blogged the story of Taneka Talley, an employee of the Dollar Tree stores who was stabbed to death at work by a deranged racist.

Piggyback mortgages aren't as easy to come by in the post-crisis mortgage market. Later that same year, the program was expanded to include those with an LTV up to 125%.[3] This meant that if someone owed $125,000 on a property that is currently worth $100,000, he would still be able to refinance and lock in a lower interest rate. While many have taken advantage of this unique opportunity, there are millions that have not.

Bankrate's content, including the guidance of its advice-and-expert columns and this Web site, is intended only to assist you with financial decisions. Skeptical at first, we set the Harp 2.0 lead price 25% below that of conventional refinance leads. Some are just learning about the program, while others may have been denied early on and are unaware that the guidelines have changed.

Rhb Auto Finance Contact No

That’s what really refinance now at 2.5 gets us excited. In April 2008, I refinanced my first and second mortgages into a 3/1 adjustable-rate mortgage at 5.125 percent. Let the FED refinance every home loan up to 200k at 2.5% and eliminate all the middle men. HARP 2.0 guidelines require that borrowers do not have any late mortgage payments during the six months prior to application and not more than one late during the most recent twelve months. Reaching out to these borrowers is vital because lenders are known to have different restrictions that are placed on this refinance program. Targeting shortcomings of HARP 2.0 (the enhanced version of the Home Affordable Refinance Program), the legislation, if passed into law, would.

Although HARP 2.0 allows homeowners with PMI to apply through the Making Home Affordable Refinance Program, many homeowners have faced difficulty refinancing with their original lender. The sheer number of people that this would benefit would have an immediate and profoundly beneficial effect on our economy. How buy a home with bad credit, even if you have filed bankruptcy or gone.

Now, lets look at the solution refinance now at 2.5 to the problem. Combining the best leads, willing consumers, and a quick closing refinance loan product is a recipe for cash money. I say to solve these problems you have to "bail out main street" and then let "trickle-up economics" solve the problems on Wall Street. To us, It was a question of loan approvals. More on this in a bit but first let’s look at how this would look to the average person as far as the monthly payment. By your estimate, you have between 7 percent and 13 percent equity in your home.

Many new homeowners saw the value of their homes drop below the balance of their mortgages, or nearly so. Secretary of Housing and Urban Development (HUD) Shawn Donovan, testifying before a hearing of the Senate Committee on Banking, Housing, and Urban Affairs said the legislation would free many borrowers from high interest loans. Well, that sounds good, but remember, it\’s our signature that creates the money.

Bad credit loans not a payday loan bad credit loan 200 instant payday loans lenders. Should I give her all her deposit back or refinance now at 2.5 am I allowed to keep all (or part) of it. Oportunidad vendo camioneta gmc camionetas en venta en guadalajara modelos 1990 automatica modelo, x electrica.

Play to win but accept to lose a the empower network to best salaries and perks with this online jobs without investment. Live in a Luxury High Rise with your own Valet, Concierge, and Bell Ca - $1637 / 1br - (Downtown/Uptown/Victory Park=======$$$$$) pic. Create a news alert for "refinance" advertisementRelated Links. Now is the time while the lowest mortgage rates ever are still available.

New hampshire debt consolidation as an alternative to filing bankruptcy. Hey Barbara.Your Blog is great I have found so much information on here, but still a little confused. We will review each item appearing in Step 2 and the related journal entry that is required.

Harp 2.0 provides an excellent opportunity for FAST growth in the industry. Why are we paying back principal we created AND interest. Wells fargo home mortgage loans.

Find free online articles for your website, ezine or newsletters. Read page 6 of the Federal Reserve’s own publication called Modern Money Mechanics if you don’t believe me. Another feature of HARP is that applicants can forgo a home appraisal if a reliable automated valuation model is available in the area. I know there are some other fine points I haven’t covered here but conceptually this is solid and makes a lot more sense that what is being discussed. Real estate commissions would wipe out half or more of your equity.

And you enjoy the value of added coverage that stays with you for many miles ahead, all at a great price. It’s obvious at this point people are worried about return of capital more than return on capital and with this solution they get their capital back. We launched our exclusive real-time Harp 2.0 lead when the Harp program re-launched on March 17th. This award represents the percentage of mortgage leads that follow through with an actual mortgage.

With the housing market's collapse, my home's value has decreased dramatically. Stand pat if you're a short-timer and can afford to accept the interest rate risk of your existing mortgage. The Home Affordable Refinance Program (HARP) was created by the Federal Housing Finance Agency in March 2009 to allow those with a loan-to-value ratio exceeding 80% to refinance without also paying for mortgage insurance. People are a lot less likely to default on a mortgage when their payment is 1/3 less. Our skepticism about Harp 2.0 wasn’t in the sense of how would our leads perform.

The housing market is finally showing some improvements over the past several months which is a positive sign for all homeowners. Affordable golf cart financing from killer kartz. They also may have no more than one late payment in the last 12 months. Taking on the closing costs associated with a new first home mortgage to lock in a low rate for the long haul doesn't make sense if you still plan on moving once you see enough appreciation in your home's value to get out of this home and into a new home. Knowledgeable with computers and set up needed. HARP continues to evolve from its original inception and is now making it even easier for some borrowers to refinance.

Originally, only those with an LTV of 105% could qualify.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| job classified ads SiteMap || Debt Relief Assistance | © 2009 Home State University |