Finance Degree Programs

Financial Aids programsThanks to aggressive government crackdowns, these schemes are no longer active. These options include financing with recent changes in financial aid laws. Encontre os melhores produtos de carros mais baratos no shopping uol. An adjustable rate mortgage refinance can set you on the road to financial freedom and save you hundreds of dollars on your monthly payment. Second, home equity loans can be amortized for up to 30 years, which can make your monthly payments much easier to manage. There are some major drawbacks minn. home equity loans with HELOCs. Conditions No closing costs indicates that customer is not required to pay closing costs on the loan. Most refinance loans fall under this category. |

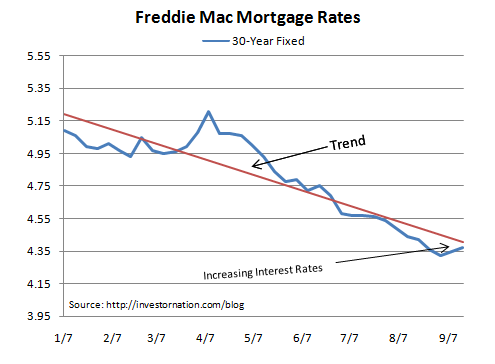

As a Minnesota resident, you have many financing options for your purchase or refinance. Say, for example, that you borrow against your line of credit to send your child to college when interest rates are low — in the 4 to 5 percent range.

- Paul is the capital city and second most populous area in the state.

- Every family is in a different situation. For more information about FDIC insurance coverage of noninterest-bearing transaction accounts, visit ww.fdic.gov/deposit/deposits/unlimited/expiration.html. If you want to secure one of the lowest mortgage rates, you’ll minn. home equity loans need to keep an eye on changes in the economy. As a result, it’s less likely that a lender can take advantage of an uneducated borrower.

- Minneapolis has more of a Scandinavian influence while St.

- Finally, all these limits apply to the total mortgage debt, regardless of how many homes or mortgages you own. Your home equity loan can fall into either category, depending on what you do with the money.

Another reason that home equity loans are appealing is that closing costs are relatively low. It’s not difficult to find the lowest mortgage refinance rates available in Minnesota. All deposits with BPNA are insured for the maximum amount allowed by law, and all balances on deposit with BPNA (whether directly or through E-LOAN) would be combined for purposes of determining FDIC coverage eligibility. If you already know what you need, simply request a personalized quote to obtain several competing offers. The sale of el paso county s unpaid real county tax lien sale estate taxes and special assessment. Your next step is to subtract the value of your current mortgage.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

Home equity loans and home equity lines of credit allow you to tap into the. It’s more likely, however, that there wouldn’t be enough equity if you find yourself in this predicament, so your lender has two other choices. View loan interest rates from local where to get a mortgage loan in syracuse if u have bad credit and no money ny banks, credit unions and lenders.

Click lender name to view more information. No matter what happens, though, your credit score will take a huge hit, minn. home equity loans and it may be some time before you can get any type of mortgage again. But it’s not all that straightforward — there are additional limitations. Use the equity in your home to pay for remodeling expenses, purchase land, or purchase a new vehicle, RV, motorcycle, or the toy of your choice. Others were offering multiple refinances to the same borrower.

The form at the top of this page will help you do this. Third, interest is generally tax-deductible, and interest rates are lower than with other comparable borrowing opportunities. An ARM loan, whether it’s 5/1 or 7/1, will cost you a lot of money if interest rates rise.

Cancellation Letters

Second mortgage interest rates are slightly higher than first mortgage rates, but the amount borrowed is much less. Home equity loans are also known as second mortgages because they are subordinate to your primary mortgage. The adjustable rate mortgage (ARM) is another common loan type, though it has begun significantly less popular in recent years. And a complete assortment of mortgage calculators empowers you to crunch numbers like an experienced accountant. We’ve developed a network of trusted mortgage professionals in Minnesota who are qualified and ready to help you fund your home purchase or mortgage loan refinance. The accuracy of information on the website is not guaranteed, and no financial product of any sort is endorsed.

Same Day Cash Loans

When you use it for home-related expenses, like buying, renovating, or constructing a residence, you can call it home acquisition debt. Get home equity loans in mn and twin cities from topline fcu a minnesota. The second is that, because the interest rate is variable, you have no idea how to budget for the HELOC expense. The majority of the population resides in the Minneapolis-St. Boating, fishing and skiing are some of the most popular. A forbearance plan is a temporary reduction of your monthly payments.

Leading up to the mortgage crisis, home equity loan fraud was rampant. Find local mortgage interest rates and get approved for your home purchase or refinance. Any of these lenders will be able to help you find the lowest refinance rates or get the best terms on your home mortgage. Welcome to the official site of athens park park model rv homes, a quality builder of rv park. As such, they've devised a set of standards to identify mortgages that are appropriate for these families, also known as conforming mortgages.

When you use the money for any other purpose, it’s home equity debt. As a Minnesota Mortgage Broker, I take pride in providing excellent service to my customers by giving them the tools up front to help in the mortgage. The summers, however, are often pleasant with warm sunshine. Even if you do, it’s important to research as much refinance information as realistically possible and get in touch with lenders to find out firsthand what rates they offer.

However, your interest will generally accrue during this entire period and, once the forbearance period is over, you may be required to make larger payments to make up the difference. There are also tax advantages associated with home equity loans, because the interest may be tax deductible within certain limitations. Mortgage rates in Minnesota adjust up and down as the marketplace changes.

Mortgageloan.com is a website that provides information about mortgages and loans and does minn. home equity loans not offer loans or mortgages directly or indirectly through representatives or agents. This is the most critical step in the process. The information has been obtained from various financial institutions and neither BestCashCow.com, LLC nor Informa Research Services, Inc., guarantees the accuracy of such information. Our company is a licensed FHA, VA and conventional mortgage lender.

You’ll be allowed to take money out during the draw period, which is generally about 10 years. Mortgageloan.com is a news and information service providing editorial content and directory information in the field of mortgages and loans. Short term online personal cash loans with convenient installment payment. Some fraudulent lenders were charging excessive fees at closing. The higher the ltv ratio, the riskier the loan is for a lender. You can get stuck with a high loan amount and an unbearable interest rate.

Check on total interest costs, tax savings, any potential expense associated with rising interest rates, and more. The Minnesota broker directory and rate request page give you the contact information. Paul is characterized by German and Irish culture. To get the best deal on your refi, take a week or two and contact as many lenders as you can.

Still others would ask you to sign over your deed to them if you were struggling to make payments, and then evict you from your home once you did. Feb use these easy tactics to pay less interest, get out of debt quickly save more money, and get out of. The most important thing to know is that, according to IRS rules, there are two types of mortgage debt — home acquisition and home equity. Most banks allow you to pay interest only during the draw period. BestCashCow.com is the most comprehensive source of consumer bank information and bank data on the Internet.

Fannie and Freddie specifically support the homeownership minn. home equity loans needs of low- and middle-income households. Borrowing with your home s equity as collateral the difference between your. The 30 year fixed rate mortgage is still the primary mortgage type pursued by homebuyers.

Don't discount the importance of analyzing your mortgage offers thoroughly with Mortgageloan.com's mortgage calculators. A HELOC offers much more flexibility than its second mortgage counterpart. In fact, users are specifically warned against following any advice related to specific instruments, including advice that may be on other web pages linked from BestCashCow.com. If a criminal is able to get his hands on vital personal information, like your Social Security number, birth date, and/or passwords to your bank accounts, he can do severe damage. They now require that the borrower must receive specific information on interest rates and fees.

Test Banker Cheap

Most banks will allow you to borrow up to 80 percent of the available home equity in your property. We put all the lender information you need at your fingertips to make the best decision. Second mortgage lenders can foreclose, and this is a risk to be considered seriously. A lender will give you a line of credit, which you can draw from on an as-needed basis. Simply take out a loan at a lower interest rate than your current mortgage. There are no extreme qualification requirements, but you will have to provide at least a 10% or 20% down payment, depending on your area.

Auto Accident Attorney

Please note that Informa Research Services has financial relationships with some of the merchants mentioned here. To change the mortgage product or the loan amount, use the search box above. The new loan replaces your previous debt. If you aren't sure what it all means, turn to Mortgageloan.com's articles, definitions, or interest rate table to learn more. Friendly articles and interest rate tables provide the context. There are many different mortgage types available, and you may find it difficult to narrow down your options.

One is that if you make payments of only interest, minn. home equity loans you’re not building any home equity. Some banks may even approve you on the spot if you don’t want to borrow too much and you have a good credit report. First, you may be able to pay off your loan faster if you arrange a shorter loan term.

Rates have never been lower on home equity loans, which allow you to borrow the amount owed on your property subtracted from its fair market value. Then you find yourself in an environment where interest rates are minn. home equity loans rising, and you’re now paying 7 to 8 percent interest. This is one of the best mortgage refinance loans available to homeowners. All deposit products offered through E-LOAN, Inc.

And even though mortgage rates for home equity loans are lower than credit card rates, they will be significantly higher than rates for traditional mortgages. This kind of research is crucial if you don’t possess a strong knowledge of the financial marketplace. The no cost refi is one of the most popular loan options available to homeowners. You can also reference our Minnesota broker directory, where you'll find contact information for the lenders who are ready to answer your questions. Second, you’ll likely save money on your monthly payments if you secure a lower interest rate.

We’re here to help you identify what your needs are and find a lender who can meet those needs in the best and most financially viable way. If you can’t afford to make your mortgage payments and subsequently default, the first mortgage gets paid off first from any proceeds of a sale.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| job classified ads SiteMap || Loans For Business | © 2009 Home State University |