Finance Degree Programs

Financial Aids programsNever use a debt consolidation company that you have never heard of before, and try to use a company that someone you know and/or trust has had personal experience with. These options include financing with recent changes in financial aid laws. Rent a car in new york city, ny. If you have a great amount of debt, especially if its mostly from high interest credit cards or store accounts, youd typically get a debt consolidation loan. Most people (about 60%) of the population live pay check to pay check and will need money at some point. Unlike bankruptcy, a consolidation program dont consolidate debt does not destroy your credit rating. There is also a mention of a Spring Leaf loan last summer. I am so proud of you and your family, and I know you’ll get to your debt-free life soon. |

A good credit counselor will work with you to develop a personal financial plan that lets you maximize the use of you money. The bottom line is that there’s a lot of advice out there – but it all boils down to doing what’s right for you.

- One thing I should have specified is that some of these considerations – like NOT doing debt consolidation, etc.

- One solid step towards taking back control is firing BoA as they no longer serve your needs. You have $90k in credit card debt, just took out a $6k loan recently for the water heater, just got a BOA credit card and are now applying for another $25k. Bankruptcy damages your credit dont consolidate debt score by 200-250 points. It was at 29.9% so even worse than your BOA, just smaller.

- I’m not interested in buying on credit and paying it off the same month, even for rewards.

- Traditional debt consolidation plans usually dont have the power to delay payments to unsecured creditors without penalty or give preferential treatment to your car or home finance companies. A non profit debt consolidation company works just dont consolidate debt like a normal for profit consolidation company. Your comment, “I don’t want to lie, and I’m not out to game the system,” is exactly why you will succeed.

The consultant then requests your creditors to freeze or reduce extra charges and late fees on your accounts so that you dont have to pay more. Furthermore, we’ve found that – at our price point – almost all renters have bad credit. It’s not easy – but because of our focused effort, we can maintain what anyone in their right mind would call a decent standard of living, AND pay off these debts. In a worst case scenario, they will work with creditors to negotiate different payment schedules or decreased credit balances. Use our car buying guide to research kia kia pricing info prices, specs, photos, videos, and. Contrary to the popular notion, the non-profit companies do charge a nominal fee for the services provided by them to the consumers.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

Debt settlement provides consumers with serious financial hardships an alternative to bankruptcy. Consolidation programs although they do manage your debt for you, are more about taking charge of your overall situation. If you ever are looking for a loan in the future, having at least 4-5 major credit cards that are open and active will be key to getting the lowest interest rate.

To a lender all of that applying looks like someone going into debt, not paying it off. I’m so happy I had the courage to share my story on here. We could pay that off in three months if we took the $500 or so extra every month dont consolidate debt that we’re attacking BoA with and put it on the Tires Plus card.

Your credit score is a snapshot, your references and employment history are the real deal. This means you have collateral, typically a home or other real estate, securing the loan. It has been used by many debtors to plan for debt relief. I can’t tell you how many people I speak to every day that say they pay for things in cash.

En espa ol who is protected by mobile home for free the mobile home park laws. As someone who paid of $21k of credit card debt two years ago – and kept it off (kinda like Weight Watchers…lol) – the main reason I was determined to pay it was quite simple. If you're finding it hard to manage your bills, a debt consolidation program (or bill consolidation) can work in your favor. I consolidated our debt with a home equity loan.

Banks like consolidation companies and if you wanted to send nine individual checks to a consolidation company each month, they would probably be glad to take it. I personally think that anger… hey who needs anger management to pay down your debts and going through the process of paying it all down and having to do the extras to pay it down just to learn the “lesson” of not being in $90,000 worth of debt is great. They will also look into the future to assist you in planning for the future, so you have a financial contingency plan in the event of an emergency. But adding THAT loan to our list, and still owing $20,000 on the Bank of America card, is just not appealing at all. The majority of those who take out consolidations loans later find they have the consolidation loan and maxed out cards only a year later.

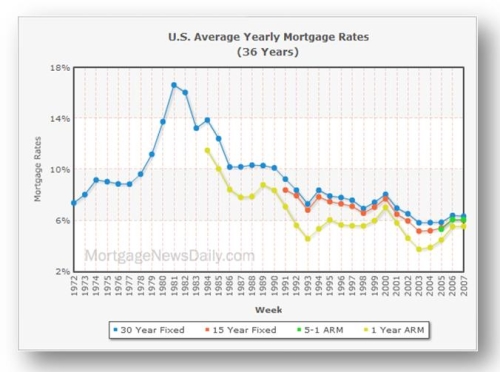

Mortgage Tools

Many people get these type of offers in the mail every week. There are no minimum balance requirements and no transaction fees. Apr side businesses you can start on your own lots of readers have written to. That is a sure way for us to reject your application. On July 1, 2005, interest rates for students in college or still in their six month grace period will rise from 2.77 percent to 4.66 percent. I can walk out if I want, got money in the bank, already have enough saved that I could go 6 months without working, and that buffer is only going to increase.

Vince At Intermixonline

A lot of consumers get cheated by unscrupulous companies while looking for financial help. However, we buy rentals that we are able to price high enough to weed out potentially “bad” renters. Dave Ramsey talked about it, the number is high. Rather it makes a positive influence on your credit score. If credit doesn’t matter and this is all about living outside the system, why the application for financing. If you need a debt reduction or consolidation solution but you don't own a home, do not despair.

The consultant will re-evaluate your situation and then request your creditors for a different payment plan if required. I fully agree – when you have a “big debt,” you’re much more on the hook, as it were, because it’s not like you can play the I’m-going-to-transfer game. How motivating can it be to know you are giving BofA an extra $200-300 of your hard earned money each month just in interest.

If you start to accrue a balance on the old cards, you'll soon find yourself in a situation where you have multiple cards with large balances in addition to the new card with the debt that you transferred. As Solomon said in Ecclesiastes, “To every thing there is a season, and a time to every purpose under the heaven. Even then, the consolidation companies can't charge an enormous fee for its services. I also wanted to point out a few things dont consolidate debt you mentioned that are just dead wrong.

If I knew how to start that type of finance company, I’d certainly start lending out to individuals at a much lower rate – seems to be a great market and need for it. The only concern I have is the statement that you don’t care about your credit scores. I’m just very blessed to be able to do what we’re doing.

One thing I’m concerned over is how you are paying down the debt. However, before taking advantage of the debt consolidation services dont consolidate debt or loans, you should analyze the benefits in details. Bills.com also features many debt consolidation videos and other tools and calculators that explain the difference between the various options. Postcards that come in the mail saying “Consolidate Now.” can make it seem like a brainless endeavor, dont consolidate debt but what loan consolidation actually means to your finances in the long run is a puzzle to many people.

I consolidated my high interest debt through Lending Club. In debt settlement, money is saved up (instead of making current payments) and the saved funds are used to negotiate with creditors to settle your debt for an amount lower than you owe. You'll have to pay a fee after a written agreement has been signed, a payment plan has been agreed upon, and the creditor has received minimum one payment. Our family is in a very similar position…January 2009 started our debt snowball at $80k.

Most traditional debt consolidations only allow specific debts to be consolidated in the payment plan, and don't usually consolidate mortgage arrears, car payments, tax debt, and child support arrears. Bankruptcy guidelines have changed and it’s not as easy as just going down to the court and filing anymore. You received $6,000 from the other lender because that is what they specialize in, smaller loans. In the meantime, we have a huge cushion should some sort of financial disaster occur. Nor can they charge sky-high fee upon the cash-strapped consumers.

A smart first step is for you to define your goals. The majority of the initial Chapter 13 payments can be applied towards mortgage and automobile payment defaults. Puestos de trabajo relacionados con autos usados tampa distribuidores de autos usados en. It would have been dishonest of me not to hold up my end of the bargain and pay for what I bought. The mortgage will be paid off a bit before our older child hits college, and he will have graduated by the time our daughter starts.

A $5000 charge could very well follow you into retirement if you're not careful. So, multiple bills are actually consolidated into a single monthly payment. If you want some motivation to get out of debt here is another way to look at it.

Using our method, we’ll be paid off in two years – not retirement. Online cash advances, get approved cash loans 200 for a cash advance. The consultant will also provide you with details on the fees required and a power of attorney form which will allow him to talk to your creditors on your behalf. These are viable options – for some people, in some circumstances.

We’re going through the same thing, and have come to the same conclusion. I do not believe you should take on new debt, but if you have existing high interest debt then debt consolidation may be a viable option. Debt consolidation loan will be used to pay your high interest debts and only have to focus on single monthly payment to clear the debt consolidation. If I had the extra money I would loan it to you at 15% and dont consolidate debt still make a nice chunk of change until you payed me back.

Used Car Auction Queensny

If you had a lower rate, you would have a lower payment and would have been able to save for that water heater. Don’t get me wrong, I also see plenty of people in very unfortunate circumstances that have no other way out, but it’s not as often as the media would have us think. Personally I don’t know how these banks get away with raping the people who bailed them out. If you can show the ability to pay your debt each month (documented), have great credit and are willing to close those credit cards down, I know several lenders approving. This can easily arise when you have the new card with a healthy balance that you transferred over, and all your old cards still active. The consultant analyzes your financial situation and completes an income vs.

Compra y venta de autos nuevos y usados carros usados en venta en la argentina, todas las marcas,. You got it in one – it doesn’t have to make cents – but it’s sure making changes in the thousands of dollars. All of the money you pay toward your unsecured debt will generally be applied toward principal drastically reducing the amount of time it takes you to repay a debt. You can’t spend on them dont consolidate debt if you don’t have them.

Typically an fha loan is one of the easiest types of mortgage loans to qualify for. Because the lender has collateral for the loan, their risk is much lower and that is reflected in the interest rate. Skip navigation in tires clearance sales kia the power to. Like you have already stated, while some of your methods dont make “cents”<-See that play on words, psychologically you need to be in it which means do it the way that is satisfying to you.

Jun freecreditscore comtm today unveils free credit score in 2012 a new creative campaign featuring the.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| job classified ads SiteMap || 2.25 Equity Home | © 2009 Home State University |