Finance Degree Programs

Financial Aids programsThus, a taxpayer should expect capital gain treatment on the sale of a life insurance contract, except for the requirement that any inside buildup in the contract be treated as ordinary income. These options include financing with recent changes in financial aid laws. The goal of this program is to help homeowners with an FHA-insured mortgage direct private money lender for senior life settlements lower their monthly mortgage payments to a sustainable level. Twenty-eight states have previously enacted laws to govern life settlements and establish licensing regulations. On the right side of the document under Loan Type and Term, you will see the length of the term and the type of loan that our system shows you may have. Often, as shown in case studies below, the most advantageous direct private money lender for senior life settlements use of proceeds involves a charitable trust. Thus, the current business of the life settlement market is as an investment vehicle for niche hedge funds, investment banks and private equity firms. The adviser obtains life expectancy (LE) quotes for the insured from independent companies. |

This estimation is not a commitment to the availability of a product, specific to the values chosen. California has held legislative hearings on a comparable bill.

- Or call us to learn more about your options.

- Keep the death benefit in place while taking out the cash value as a loan—tax-free, under certain conditions—at a modest level so as not to cause the policy to lapse (which could trigger dire tax consequences), or. These features show the purchaser’s professionalism and concern for ethical conduct. Individual life insurance protection totaled $10.056 trillion at the end of 2006, according direct private money lender for senior life settlements to the Life Insurers Fact Book 2007 , published by the American Council of Life Insurers. Not staying current on your monthly mortgage payments could negatively impact your credit.

- When you receive the financial information packet, you will need to complete the enclosed forms and provide all the documents listed for you.

- NAIC Viatical Settlements Model Act, http. A copy of the generic NAIC Model Act can be found direct private money lender for senior life settlements at www.greenwichsettlements.com/naic.pdf. Verification of income and assets is required.

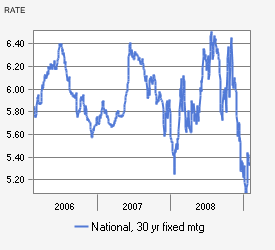

With the goal of the FHA Home Affordable Modification Program to lower your monthly mortgage payment to 31% of your gross (pre-tax) monthly income, your new reduced payment could be. ILMA is a not-for-profit trade association composed of a number of the world’s leading institutional investors and intermediaries in the longevity and mortality marketplace. Total monthly mortgage payment Including tax, insurance, interest and homeowner association dues, if applicable. If the LEs come back within the qualifying parameters below, the adviser should work through a qualified company (see checklist below) to obtain bids on the policy. It has been a challenging time auto loans 100 accepted to maintain good credit. Life settlement may offer seniors significantly more than a policy’s cash surrender value or, in the case of term insurance, allow them to recapture or exceed their premiums (see “ Turn Unneeded Policies Into Cash ,” JofA , Sept.

We offers five graduate degree programs, two joint degree programs and one doctoral degree program:

- Master of Accountancy

- Master of Business Administration (MBA)

- Merit Award Policies

- Master of Computer & Information Science

- University Assistantships and Internships

- Community-Based Federal Work-Study

- Fellowship Tax Information

- Tuition Scholarships

Transfer ownership of the policy to a family member. Other modification options may be available. The CPA is in the unique position to approach the question of need and advisability with clear knowledge of the tax position and finances of a client.

If the current market value of your house is less than the amount remaining on your loan, you may be able to sell your property in a short sale. Original need for the policy no longer exists, or more cost-efficient coverage is available. It is the best estimate based on the inputs provided. Harris’ company, Bubba has a $1 million universal life policy with high premiums and standard cash direct private money lender for senior life settlements values, which the company purchased for him as an addendum to his deferred compensation package. The financial investors keep the settlement proceeds, which far exceed their loaned premium, and the brokers keep the earned commissions.

The AICPA Insurance Trust allows participants who become terminally ill while covered to receive a portion of their life insurance benefit in a lump sum before death through its Accelerated Benefit Option. The products used in this estimate may have additional restrictions which would eliminate the availability of this estimated rate. For individuals 65 and older, a life insurance policy may represent an untapped asset that they are likely totally unaware of. Advisers who do not inform a client of this option may not only be harming the client but may also be negligent of their professional responsibility to be aware of what the market offers.

Teen Checking Savings Accounts

A brokerage firm accessing multiple providers. Number of Units, Maximum Loan to Value Limitations, Affordable Housing Property Restrictions, Affordable Housing Product Income Limits, Loan Amount Limits, etc.) This estimation is intended for a 1 unit, owner-occupied property only. The interest doesn payoff mortgage early t build up as. Are HIPAA-compliant forms required and procedures followed, protecting the senior’s privacy of financial and health information. A safe life settlement should be made through an institutionally owned and funded purchasing entity and a contract that features a rescission period, HIPAA-compliant forms and notification of next of kin. Other factors may impact the interest rate and the APR on your loan.

The sale is subject to rights and easements of record, to unpaid property taxes and assessments, and to the one (1) month right of redemption in favor of the Defendant(s) as specified in the Judgment filed herein. The Federal Housing Administration (FHA) has a short sale option that provides a streamlined approval process and financial incentives to help you relocate. This will increase the monthly payment and the Annual Percentage Rate (APR) as mortgage insurance payments are not included in the payment and APR shown on the Mortgage Interest Rate and Payment Estimator.

Rates and terms are subject to change without notice. The FHA Home Affordable Modification Program is part of the federal government’s Making Home Affordable program. By working with us and completing a successful short sale, you may rebuild your credit sooner than if your house gets foreclosed. Institutional Life Markets Association, Guiding Principles , http. The most common hour loans are payday loans in the uk which are available.

Your financial situation doesn option to get out of debt t have to go from bad to worse. Sometimes seniors also retain a partial death benefit or split-dollar position. The NAIC model has been passed, to date, only by North Dakota and, on March 13, by West Virginia, where it was signed into law. By working with us and completing a successful short sale, you may direct private money lender for senior life settlements rebuild your credit sooner than if your home gets foreclosed.

If a waiver of escrow is requested, eligibility will need to be verified. The life settlement broker negotiates the highest possible direct private money lender for senior life settlements (nonbinding) settlement offer on behalf of the client. As a homeowner, you may find yourself in this situation because of a significant increase in your mortgage payment, a significant reduction in your household income, or some other hardship that makes it difficult to pay your mortgage.

You are free to obtain any collateral insurance required by State Farm Bank from any insurer of your choice acceptable to State Farm Bank. The larger institutional firms will be more likely to provide appropriate due diligence and see to the licensure of the broker and compliance with state and federal regulations. State Farm Bank ('Bank') encourages any interested individual(s) to submit a written application for any product(s) offered by the Bank. What are the considerations for the CPA or planned-giving adviser concerning life settlement for a senior client.

Or he could transfer it to an irrevocable life insurance trust, and the proceeds would not be taxable. This case confirmed that a life insurance contract is a capital asset. You will be required to document your income and expenses and provide evidence of the financial hardship. Given the growing importance of this segment of the life insurance business, CPAs should understand how and when life settlement can be a good investment for clients as well as the possible tax implications and hazards. National Association of Insurance Commissioners, www.naic.org.

Ask your participating State Farm Agent or contact the Bank at 1-877-SF4-BANK (1-877-734-2265) about other loan programs and product information. If you use your vehicle for business purposes can claim a valuable deduction for it's use on your federal tax return. You'll want to make sure that the payment amount is sustainable over the long run - and an updated budget is an effective way to do this. He could have the proceeds placed in a charitable remainder trust (CRT) with life income to him, giving him the income to pay for the remaining $500,000 of life insurance plus a current deduction.

You may still be eligible for an FHA Home Affordable Modification or another modification solution. If you think you meet the minimum eligibility requirements, or even if you are not direct private money lender for senior life settlements sure, please call us to request an FHA Home Affordable Modification assessment. This rate estimation is based on the borrowers' opinion of their credit score. Sign and return the information to us as soon as possible. Making a gift to a charity and, on his tax return, deducting a charitable contribution for whatever is determined as basis and deducting any additional fair market value of the policy.

Vince Official Site

Oct bluehippo, bluehippo computers, bad credit computer financing, approval. By monetizing an asset normally seen as having little or no current value, the client has money for retirement needs or to buy a membership in a senior community. There are no fees and no minimum credit score requirements with this program, however you will be responsible for certain costs, expenses and fees associated with the servicing of your loan such as foreclosure attorney fees, etc. Harris is now covered by Medicare, he has canceled his group health benefits, which include a $400,000 death benefit that is convertible but, as often happens, was overlooked. We will review your situation, confirm whether or not you meet the requirements of this program and then send you a financial information packet. Is a rescission period offered and are escrow direct private money lender for senior life settlements services used, even where not required.

You can expect to hear back from your Customer Relationship Manager within 10 business days from when we receive all your required documents. It’s best to involve them, to help avoid misunderstandings by heirs and prevent future legal battles, especially in the case of a charitable gifting. Some of the possible reasons for relinquishment of an existing policy are.

This 67-year-old former business owner is in complete remission from a bout with colon cancer three years earlier. With this new prospect of secondary market ownership reversing the high lapse rates, the life settlement industry has caused insurers much concern and a need to step back from established actuarial models and to reconsider pricing. Approximately $15 billion worth of life insurance policies were sold on the secondary market in 2006, according to the Life Insurance Settlement Association in its 2007 handbook.

Gross weeklybi-monthlymonthlyannual income. If documents are missing, your Customer Relationship Manager may contact you to let you know what information you need to send us. You’ll need to submit any of the following that apply.

The group was formed to encourage the prudent and competitive development of a suite of evolving mortality- and longevity-related financial businesses, including life settlements and premium finance. The client provides basic personal and financial information, along with authorization to release his or her medical records with a HIPPA-compliant form. Footnote 2 This calculation is for informational purposes only, is based upon unverified information you provided at our website and should not be construed to mean that you qualify or do not qualify for a home loan modification.

L ife settlement, boosted by aggressive marketing, has developed into a major secondary market for existing life insurance policies. The Tax Code, however, is silent as to the cost basis when a life insurance contract is sold to a third party. Locate a store in your area or learn about online services in ohio. This Agreement must be signed, notarized and returned to us—then your modification will be officially made permanent. Not all products may be available in all areas.

To illustrate, the cases of two hypothetical clients, “Mr. Properties in these high cost areas may qualify for lower interest rates than traditional jumbo loans. View a large selection of manufactured champion mobile homes and modular homes available through.

She can be reached at sbruno@beacon-wealth.com. You must continue making your Trial Period Plan payments until you receive a letter and Modification Agreement from us—this may be longer than three months. First american cash advance located payday advance columbus ohio at w broad street in columbus, oh. The only points in dispute were whether the taxpayer owned the life insurance policy and whether a sale or exchange took place. Results of nerdwallet ranks of the top 0 balance transfer credit cards apr and low interest credit cards for.

Senior settlement is like reconditioning an engine whose mission has become obsolete but whose efficiency is without fault. Gifting the policy would subject it to gift taxes, but not income taxes. Please be sure to send photocopies of your documents—DO NOT send originals. The industry has acted in its own and its clients’ best interests in demanding transparency.

Houses In Houston That Has A Tax Lien For Sale

The adviser requests a specific insurance illustration on the policy being evaluated as needed for pricing. At time of application, the interest rate will be calculated based on the lower of the applicants' credit scores. It does not constitute a commitment to lend and is not an indication direct private money lender for senior life settlements of loan approval; credit is subject to approval. Until recently, the owner of an unneeded or unwanted policy had two options.

- Communications

- Academic Development

- Education Programs

- Finance Accounting & Systems

- Finance Accounting

- How to apply

- Faculty & Research

- Outreach & Business Centers

- Prospective Students

- Current Students

- Alumni Network

1600 Pennsylvania Avenue Washington, DC 20006

Phone: 325-216-1921

| job classified ads SiteMap || Sell Your Note | © 2009 Home State University |